Answer:

monthly payment is about $1422 (rounded)

"taking this loan would be a smart decision because even after paying off the loan, he is still making a handsome profit (because his income per month is more than his loan payment)."

Explanation:

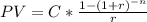

The loan is an annuity so we use the formula for annuity to find the monthly payments he has to make.

Where

PV is present value of the loan (250,000)

C is the monthly payment (what we are trying to find)

n is the number of months (30 years * 12 = 360 months)

r is the rate of interest per month ( i = 5.5%/12 = 0.0046)

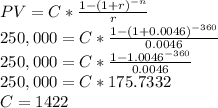

Putting these values, we solve for C:

So monthly payment is about $1422 (rounded)

Since, each of the 8 apartments are going to be rented out at 500, total monthly income would be 8 * 500 = $4000

taking this loan would be a smart decision because even after paying off the loan, he is still making a handsome profit (because his income per month is more than his loan payment).