Answer:

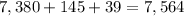

Part A:

Rent = $7380

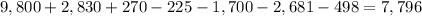

Mortgage payments = $9800

Insurance = $145

Taxes, insurance, maintenance =

= $2830

= $2830

Loss of Interest on security deposit = (650*6%) = $39

Interest lost on down payment and closing cost = (4,500*6%) = $270

Growth in equity = $225

Annual appreciation = $1700

Tax savings for mortgage interest = (9,575*28%) = $2,681

Tax savings for property taxes = (1,780*28%) = $498

Total rental cost =

dollars

dollars

Total buying costs =

dollars

dollars

Part B:

You should consider rent because the cost of renting is less than the cost of buying.