Answer:

1.- issued at : $579,378

2.- the schedule is attached.

3 and 4.- journal entries

cash 579,378 debit

discount on bonds payable 20,622 debit

bonds payabe 600,000 credit

--to record issuance-------

interest expense 20278.23 debit

discount on bonds payable 2278.23 credit

cash 18000 credit

--to record June 30th payment---

5.-At December 31th 2018 will report as follow:

bonds payable 600,000

discount on bonds (15,986)

net 584,014

6.- it will report interest expense for:

20,278.23 June

20,357.97 December

total: 40.636,2

7.- maturity:

interest expense 20,898.55

discount on bonds payable 2,898.55

cash 618,000

Step-by-step explanation:

For the value of the bonds at issuance, we will calcualtethe present value of the coupon payment and the maturity at market rate.

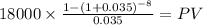

C 18,000 ( 600,000 x 0.06/2)

time 8 (4 years x 2 payment per year

rate 0.035(market rate / 2)

PV $123,731.1997

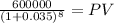

Maturity 600,000.00

time 8.00

rate 0.035

PV 455,646.93

PV c $123,731.1997

PV m $455,646.9337

Total $579,378.1334

for the schedule we will multuply the carrying value by the market rate.

the ncompare with the proceed in cash to know the amortizaiton.

This amortization will increase the carrying value of the loan.