Answer:

Ans. A) Danny can retire in 38 years; B) Hugh will retire 5 years sooner (retires in 33 years; C) Hugh´s account will have $504,327.38 in 25 years, D) Danny´s annual contribution has to be $9,873.20 if he wants to retire in 33 years, like Hugh.

Step-by-step explanation:

Hi, in order to answer all this questions, we have to use the following equation.

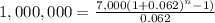

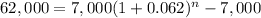

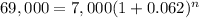

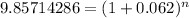

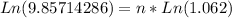

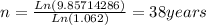

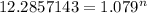

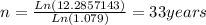

To solve the first question, we have to solve for "n" this equation, the math to this as follows.

To answer B), we need to do the same process, only that we change 0.062 for 0.079, but all the process is the same.

Since Danny will retire in 38 years and Hugh in 33, Hugh is going to retire 5 years sooner than Danny.

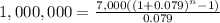

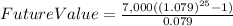

C) To find the balance in 25 years in Hughs Account, we just go ahead and use the formula to find the future value, like this.

This means that FV= $504,327.38

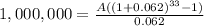

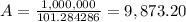

D)in order to find the annual payment that Danny has to make in order ti retire in 33 years, just as Hugh, we need to solve the initial equation for "A".

Best of luck.