Answer:

PTM $ 1,225,900.379

Step-by-step explanation:

We will calculate the present value of the contract.

Then we will increase by 1,200,000

Next, we subtract the 9.2 bonus payable today

and distribute the rest under quarter payments:

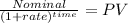

We use present value of a lump sum

0 5,700,000 5,700,000

1 4,300,000 4,102,588.223

2 4,800,000 4,369,383.7

3 5,300,000 4,603,035.135

4 6,700,000 5,551,785.732

5 7,400,000 5,850,312.795

6 8,200,000 6,185,156.501

Then we add them: 36,362,262.09

We increase by 1,200,000

and subtract the 9,200,000 initial payment

28,362,262.09

this is the present value fothe quarterly payment

Next we calculate the equivalent compound rate per quarter:

![(1+(0.047)/(365) )^(365) = (1+(r_e)/(4) )^(4) \\r_e = (\sqrt[4]{1+(0.047)/(365) )^(365)} - 1)* 4](https://img.qammunity.org/2020/formulas/business/college/p8bu9cyv8kaf5z52set8emdf2u0zfgqyew.png)

equivalent rate: 0.002954634

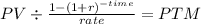

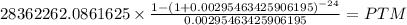

Now we claculate the PTM of an annuity of 24 quearter at this rate:

PV $28,362,262.09

time 24

rate 0.002954634

PTM $ 1,225,900.379