Answer: $225,000

Step-by-step explanation:

Given that,

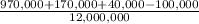

Company acquired a mine = $970,000 of this amount,

Land value = $100,000 and remaining portion to the minerals in the mine

Ore appear to be in the mine = 12,000,000 units

Aristotle incurred development costs = $170,000

fair value of its obligation = $40,000

ore were extracted = 2,500,000 units

Units sold = 2,100,000

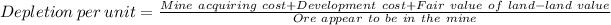

=

= $0.09 depletion per unit

The total amount of depletion for 2017 = depletion per unit × ore were extracted

= $0.09 × 2,500,000

= $225,000