Answer:

16 years to maturity

Step-by-step explanation:

We will calculate time:

The bonds present value is 896.23

YTM 10.34

and the face value is 1,000

Coupon Payment: 45 (1,000 x 9% / 2 payment per year)

time n

rate 0.0517 (10.34/2 payment per year

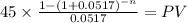

PVc

Maturity 1,000.00

time n

rate 0.0517

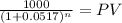

PVm

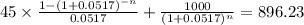

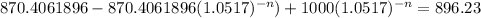

PV c + PV m = 896.23

We rearrenge:

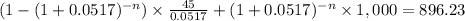

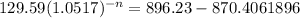

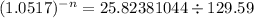

We solve to clear the expression 1.0517 power -n:

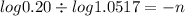

We now use logarithmics properties:

n = 32.00

These are semianual payment, so we will divide by two to get the time expressses in years:

32/2 = 16 years to maturity