Answer:

The EMV for option a is $5,679,100

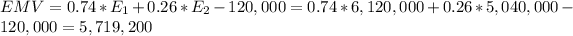

The EMV for option b is $5,719,200

Therefore, option b has the highest expected monetary value.

Step-by-step explanation:

The EMV of the project is the Expected Money Value of the Project.

This value is given by the sum of each expected earning/cost multiplied by each probability.

So

a) proceeding immediately with production of a new top-of-the-line stereo TV that has just completed prototype testing.

There are these following probabilities:

77% probability of selling 100,000 units at $610 each.

23% probability of selling 70,000 units at $610 each.

So

(b) having the value analysis team complete a study.

There are these following probabilities:

74% probability of selling 85,000 units at $720.

26% probability of selling 70,000 units at $720.

The cost of value engineering, at 120,000. So this value is going to be dereased from the EMV.