Answer:

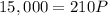

Ans. The price has to fall to $71.43 in order to get a margin call on this bullish position.

Step-by-step explanation:

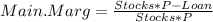

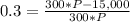

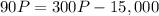

Hi, you get a margin call when the amount of money that you have equals the maintanace margin. That means, in this case, if the price drops below a certain value, you will have less than the maintenance margin to pay the loan that you made. Since this happens immediately, there is no need to include the interest rate in this calculation. What we need to do is solve for "P" the following equation.

Where:

Stocks: The number of stocks that you bought (own money +loan)

(15,000(Own)+15,000(loan))/$100 PerShare= 300 shares

The stock has to drop immediately to $71,43 from $100 (original value) for you to get a margin call.

Best of luck.