Answer:

The airport should invest a uniform amount of

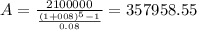

$357,958.55

$357,958.55

Step-by-step explanation:

Hi

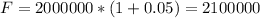

First of all, we need to know how much will cost the land in five years so we have,

, that means that the future value of the land will be $2'100,000.

, that means that the future value of the land will be $2'100,000.

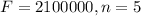

Now we can use

with

with

and

and

%, so we have

%, so we have