Answer:

YTM 5.2% present value: $1,023.1644

YTM 1% present value: $1,427.2169

YTM 8% present value: $830.1209

YTM 8% present value: $515.7617

Step-by-step explanation:

YTM we will calculate the present value of the coupon payment

andthe maturity at each YTM rate given:

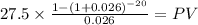

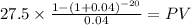

The coupon payment present value will be the present value of an ordinary annuity

Coupon payment 28 (1,000 x 2.75%)

time 20 (10 years x 2 payment per year)

rate 0.026 (YTM over 2 as the payment are semiannually)

PV $424.6800

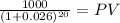

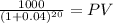

The present value of the maturity will be the present value of a lump sum:

Maturity 1,000.00

time 20.00

rate 0.026

PV 598.48

PV c $424.6800

PV m $598.4843

Total $1,023.1644

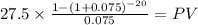

Now, we will calculate changin the YTM the concept and formulas are the same, just the rate is diffrent:

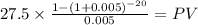

If YTM = 1%

PV c $522.1540

PV m $905.0629

Total $1,427.2169

If YTM = 8%

PV c $373.7340

PV m $456.3869

Total $830.1209

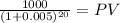

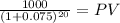

If YTM = 15%

PV c $280.3485

PV m $235.4131

Total $515.7617