Answer:

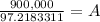

Ans. your monthly payment, for 30 years is $9,257.51 if you buy a property worth $1,000,000 and you make a down payment of $100,000

Step-by-step explanation:

Hi, first we have to change the fixed rate in terms of an effective monthly rate, which is 1% effective monthly (12% nominal interest/12 =1% effective monthly). After that, take into account that the property is going to be paid in 30 years, but since the payments are going to be made in a montlhly basis, we have to turn years into months (30 years * 12 = 360 months).

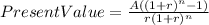

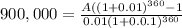

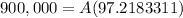

After all that is done, all we have to do is to solve the following equiation for "A".

Where:

A= Annuity or monthly payment

r= Rate (effective monthly, in our case)

n= Periods to pay (360 months)

Everything should look like this.

Best of luck.