Answer:

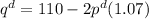

- The Demand is given by

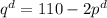

- The supply curve is by

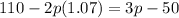

Consumers will face a price of 33.29 and the equilibrium quantity will be 43.42.

These results illustrate that as a consequence of the tax, the price faced by consumers will be higher, quantity sold be lower, and producers will receive less for their product sale.

Step-by-step explanation:

- The Demand is given by

- The supply curve is by

In the absence of taxes

and

and

.

.

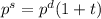

An ad-valorem tax

generates now that

generates now that

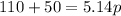

So the new equilibrium is

Replacing in the demand equation we get the equilibrium quantity