Answer:

Ans. Effective annual rate=1.8928%

Annual Compound semi-annually=1.8839%

Explanation:

Hi, this is the formula to find the effective annual rate for this zero-coupon bond.

![EffectiveAnnualRate=\sqrt[n]{(FaceValue)/(Price) } -1](https://img.qammunity.org/2020/formulas/mathematics/college/u264oifjnjd6vutdhz101so0ihbeqn7d9v.png)

n= years to maturity

That is:

![EffectiveAnnualRate=\sqrt[8]{(50,000)/(43,035) } -1=0.018928](https://img.qammunity.org/2020/formulas/mathematics/college/5etchb2f51ey0wrz2riwsihg4qh5nl8hly.png)

Means that the effective interest rate is 1.8928% effective annual

Now, let´s find the compound interest rate.

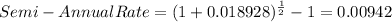

First, we have to turn this rate effective semi-annually

0.942% effective semi annual

To turn this into a semi-annual, compounded semi-annually, we just have to multiply by 2, so we get.

1.8839% compounded semi-annually

Best of luck