Answer:

4.08 + 2 = 6.08 years

Explanation:

we know that

Simple Interest(S.I.) = (P × R × T) ÷ 100

where, P = Principal = 750

R = Rate = 6%

T = unknown

⇒ S.I. = (750 × 6 × t)÷ 100

⇒ S.I. = 45t

Also, Amount = S.I + Principal

⇒ Amount = 750 + 45t

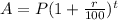

Now Formula for Compound Interest is:

where A = Amount

=1000

P = Principle

r = rate

t = total number of year

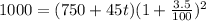

Here, P = 750 + 45t, r = 3.5% , and t = 2.

Putting all these values in above formula:

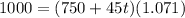

⇒

⇒ t = 4.08

Hence, total time required will be 2 + 4.08 = 6.08 years.