Answer:

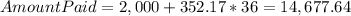

Ans. For option 1, you would pay a total of $14,677.64 and for the second option, you would pay $14,000.

Explanation:

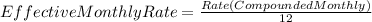

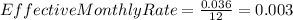

Hi, we need to find the amount of the equal payments that you need to make every month, given the problem´s conditions. First, let´s find the effective montly rate of this credit.

This means that the rate is 0.3% effective monthly

The period of time for this obligation is 3 years, but since the payments are made every month, we need to use 36 months instead of 3 years.

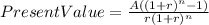

Now, we are ready to find the amount of money that you need to pay every month, for 36 months in order to pay for your car. We use the following formula.

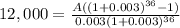

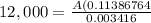

Since you made a down payment of $2,000, we will only need to finance $12,000. This is the way everything should look like.

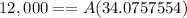

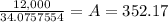

Let´s solve for A (annuity)

}

}

The total amount paid if you take this option is:

In the case of option 2 (0% loan-pay same amount every month for 36 months), there is no need for any calculations (because you pay $14,000 in total), but if you want to know how much to pay every month, you just go ahead and divide 14,000 by 36 which is $388.89. But at the end, this way you will pay $14,000.

Best of luck.