Answer:

a) You should invest $6941.90 today.

b) The effective annual interest rate is 11%.

c) t is approximately 6.

Explanation:

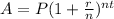

These are compound interest problems. The compound interest formula is given by:

Where A is the amount of money, P is the principal(the initial sum of money), r is the interest rate(as a decimal value), n is the number of times that interest is compounded per unit t and t is the time the money is invested or borrowed for.

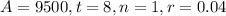

a) How much would you invest today to have $9500 in 8 years if the effective annual rate of interest is 4%?

Here, we want to find the value of P when

.

.

.

.

You should invest $6941.90 today.

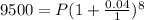

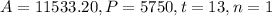

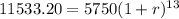

b) Suppose that an investment of $5750 accumulates to $11533.20 at the end of 13 years, then the effective annual interest rate is i= ?

Here, we have that

, and we want to find the value of i, that is r on the formula above the solutions.

, and we want to find the value of i, that is r on the formula above the solutions.

![\sqrt[13]{11533.20} = \sqrt[13]{5750(1 + r)^(13)}](https://img.qammunity.org/2020/formulas/mathematics/college/saodvxmng4sd0zv0kl3x4p8pgudcvzj0us.png)

The effective annual interest rate is 11%.

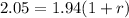

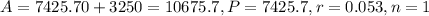

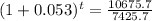

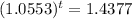

c) At an effective annual rate of interest of 5.3%, the present value of $7425.70 due in t years is $3250. Determine t.

Here, we have that

and we have to find t. So

and we have to find t. So

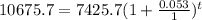

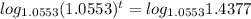

We have that:

log_{a}a^{n} = n

So

t is approximately 6.