Answer:

Ans. Joe will have $720,862.28 and Jill will have $819,348.90 after 30 years.

Explanation:

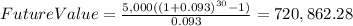

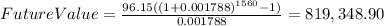

Hi, since the interest is compounded with each payment, the effective rate of Joe is exactly equal to its compounded rate, that is 9.3%, but in the case of Jill, this rate is compounded weekly, this means that we have to divide 9.3% by 52 (which are the weeks in a year) in order to obtain an effective rate, in our case, effective weekly.

On the other hand, the time for Joe is pretty straight forward, he saves for 30 years at an effective annual interest rate of 9.3%, but Jill saves for 30*52=1560 weeks, at a rate of 0.1788% effective weekly.

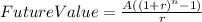

They both have to use the following formula in order to find how much money will they have after 30 years of savings.

In the case of Joe, this should look like this

In the case of Jill, this is how this should look like.

Best of luck.