Answer:

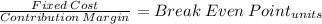

BEP units: 42,017

BEP dollars: 2,100,850

unit cost at 100,000 units produced: 22.40 dollars

operating profit : 1,656,000

Step-by-step explanation:

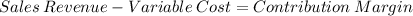

50 - 2.4 = 47.6 contirbution margin per unit

2,000,000/47.6 = 42.016,80 BEP units

BEP units x sales price = BEP dollars

42,017 x 50 = 2,100,850

(B)

fixed cosy/ units produced = fixed cost per unit

2,000,000/ 100,000 = 20 fixed cost per unit

fixed cost + variable cost = total cost

20 + 2.40 = 22.4

(C)

There are 40% units sold at the preferred customer at cost

So we sale at gain only 60% of the units:

100,000 units x 60% x 50 = 3,000,000

100,000 units x 40% x 22.40 = 896,000

Total revenue 3,896,000

Cost: 100,000 x 22.40 (2,240,000)

operating profit 1,656,000