Answer:

It will have 34,351 available for a down payment at the end of Year 3

Step-by-step explanation:

savings:

first year: 10,000

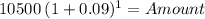

second year 10,000 + 5% = 10,000 x 1.05 = 10,500

third years (10,000 + 5%) + 5% = 10,500 x 1.05 = 11,025

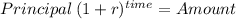

return on Invetment

The first saving will capitalize for two years at 9%

First year: 10,000.00

time 2.00

rate 0.09

Amount 11,881.00

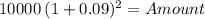

The second savings will capitalize for one yeat at 9%

Second year: 10,500.00

time 1.00

rate 0.09

Amount 11,445.00

Total amount:

11,881 + 11,445 + 11,025 = 34,351