Answer:

Step-by-step explanation:

the minimun value is expressed by the present value of the investment using a 7% rate, lets recall the formula for finding present values:

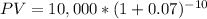

where, PV is present value, FV is the future value, and n is time elapsed. So applying to this problem we have:

So the minimun value which is profitable to pay is 5,083.49 today, in that sense you will get a return on 7% compounded after 10 years