Answer:

YTC = IRR = 12.844% (exact using excle of financial calculator)

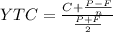

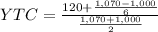

using approximation formula: 12.72%

Step-by-step explanation:

The call premium means it were called at 107 of the face value

1,000 x 107/100 = 1,070

The investment was for 1,000

The bond yield a six years annuity of 120

and then called at 1,070

We need to know teh YTC:

Coupon payment =1,000 x 12% = 120

Call Price: 1070

Face Value: 1000

n: 6 years

YTC = 12.7214171%

This method is an aproximation to the YTC

To solve for the YTC we can use excel IRR funtion

we write

-1,000 (investment)

120

120

120

120

120

+1,070+120 = 1,190 (total cashflow at year 6 call price and coupon)

and we calculate IRR selecting this values:

which give us 12.844%

Which is close to our approximation.