Answer:

The bond's yield to maturity is 9.45% using Excel to get exact values, and 9.59% using approximate method.

Step-by-step explanation:

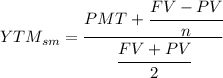

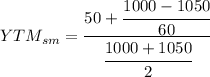

We can calculate is using 2 ways, using Excel to get the exact percentage or with approximate methods, calculating the semi-annual Yield to Maturity using the following formula

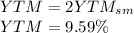

And from there we can calculate the Yield to Maturity just by multiplying the semi-annual one by 2.

Identifying the given information.

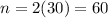

We have a period of 30 years, so for the semiannual bond we have

periods.

periods.

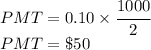

The face value, FV, is $1000, the coupon rate is 0.10, thus we can use them to find the interest per period PMT.

The current price of the bond, PV is $1050.

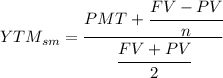

Replacing the values on the semiannual Yield to Maturity

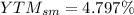

Simplifying we get

Finding the Yield to Maturity.

We can just multiply by 2 to get the Yield to Maturity from our previous result and rounding it to 2 decimals we get

Alternatively we can use Excel and write:

RATE(n, PMT, PV, FV)*2

That is

RATE(60,50,1050,1000)*2

And we will get the exact Yield to maturity 9.49%