Answer:

Ans. The after-tax rate of return on the municipal bonds is 3% and the after tax rate of return on the corporate bonds is 4.5%

Step-by-step explanation:

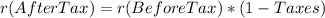

Hi, the formula to find the after-tax rate of return of any taxable income is as follows.

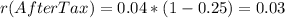

Therefore, in the case of the municipal bond.

So, the after-tax rate of return of the municipal bond is 3%.

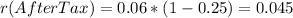

And for the corporate bond is.

And the after-tax rate of return of the corporate bond is 4.5%.

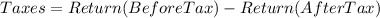

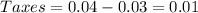

It means that taxes on municipal bonds are:

In the case of municipal taxes:

1% taxes for municipal bonds

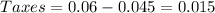

In the case of corporate taxes:

1.5% taxes for corporate bonds

Best of luck.