Answer:

14.93%

Step-by-step explanation:

Given:

For taxable income $9,275, tax rate = 10%

For taxable income $28,375, tax rate = 15%

For taxable income $53,500, tax rate = 25%

Now,

Tax on income = tax rate × taxable income

thus,

Total Tax on first $9,275 = $9,275 × 10% = $927.5

and,

Total tax on next $28,375 = $28,375 × 15% = $4,256.25

Therefore, the total income that has been taxed till the $9,275 + $28,375

= $37,650.

and, the amount left to be taxed = $42,000 - $37,650 = $4,350

Thus,

Tax on remaining $4,350 = $4,350 × 25% = $1,087.5

Total tax = $927.5 + $4,350 + $1,087.5 = $6,365

Therefore,

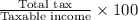

The average tax rate =

or

The average tax rate =

or

Average tax = 14.93%