Answer:

Ans. A) NPV= -$9306

Step-by-step explanation:

Hi, the first thing we need to do is to find the after-tax cost of the firm's capital, and since all capital sources are expressed in terms of after-tax percentage, we just multiply each proportion of capital by its costs, I mean

Long term Debt (7%) * 25% +Preffered Stock(11%)*15% + Common Stock(15%)*60%

The answer to this is 12.40%.

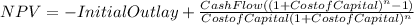

Now, we can find the net present value of this project by using the following formula.

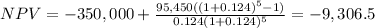

Since the expected cash flow takes place 5 times form year 1 to 5, and is equal to $95,450, "n" is equals to 5 and "CashFlow" is equal to $95,450.

Therefore, the NPV of this project is -$9,306, which is answer A)

Best of luck.