Answer:

$1100.

Step-by-step explanation:

We have been given that Nyle Corp. owned 100 shares of Beta Corp. stock that it bought in 1993 for $9 per share. In 2014, when the fair market value of the Beta stock was $20 per share.

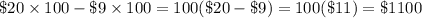

Nyle's recognized gain on this distribution would be:

Therefore, Nyle's recognized gain on this distribution was $1100.