Answer:

The retirement fund will provide 87,148.56 dollars per year during 20 years

Step-by-step explanation:

The plan is to achieve 1,000,000 in 30 years.

Then we will spend them equally during a period of 20 years

We want to knwo how much will the retirement account provide.

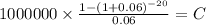

So, we need to calculate the cuota of an annuity of 20 years with a presenet vale of 1,000,000 dollars at 6% discount rate:

PV $1,000,000.00

time 20 years

rate 6% = 6/100 = 0.06

C $ 87,184.56

The retirement fund will provide 87,148.56 dollars per year during 20 years