Answer:

The actual direct labor hours are 45,000.

The overhead rate for Year 2 is $1.74.

Step-by-step explanation:

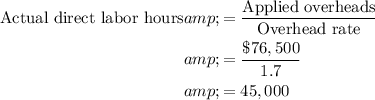

Compute the actual direct labor hours:

Therefore, the actual direct labor hours are 45,000.

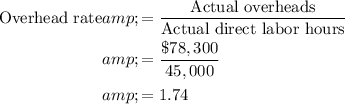

Compute the overhead rate for Year 2:

Therefore, the overhead rate for Year 2 is $1.74.

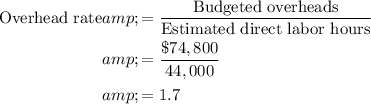

Working note:

Calculate the overhead rate for Year 1: