Answer:

A) If Bella contributes 3,719.98 per year during 42 years it will get 2,000,000

B) 258.25 if the payment are monthly

C) Because, the retirement is a long-run reward while spending the income in the younger years may be seens as better deal for most americans n my humble opinion.

Step-by-step explanation:

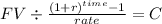

we will calculate which annuity will equal a future value 2,000,000 at 10% in the period of time from 23 years to 65 years:

PV $2,000,000.00

time 42 (65 years - 23 years )

rate 10% = 10/100 = 0.1

C $ 3,719.98

If Bella contributes 3,719.98 per year during 42 years it will get 2,000,000

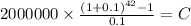

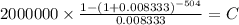

IF the payment are monthly, we will increase time and adjust the rate:

PV $2,000,000.00

time 504 (42 years x 12 months per year)

rate 0.008333333 (0.1 / 12 months per year)

C $ 258.25