Answer:

It should be rejected

IRR 16.23% while cost of capital 19%

Step-by-step explanation:

investment: 116,440

useful life of 4 years

It will increase revenue by 80,900

and expense by 39,100

The net cash flow will be of 41,800

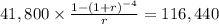

Now we calculate the IRR of the projectwhich isthe rate at which the annuity PV equal the investment

C $41,800

time 4 years

PV $116,440

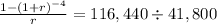

we can look at the PV table for the vlaue of the factor on time 4 which is closest to the IRR facor:

That's between 16% and 17%

we can now do trial and error on the rate between this number

or we can also solve for using Excel or a fianncial calculator

the IRR will be 0.1623 = 16.23%

With this information we have the decision on the project.

The required return is 19% and the IRR will be between 16 and 17% so it should be rejected