Answer: Option (B) is correct.

Step-by-step explanation:

Capital contribution by David = $40,000

Interest of David in partnership =

Total capital of the partnership after the admission of new partner:

=

= $200,000

Total capital of partnership before decreasing of obsolete inventory:

= $140,000 + $40,000 + $40,000

= $220,000

Therefore, value of decrease in inventory:

= Total capital before decrease - Total capital after decrease

= $220,000 - $200,000

= $20,000

The reduction in value of inventory will be distributed in old partners in ratio of 3:1

Hence,

Capital balance of Allen after admission of David:

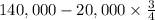

=

= $125,000

Capital balance of Daniel after admission of David:

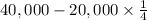

=

= $35,000