Answer:

Cuota: 808.91

100th cuota:

Amortization 561.07

Interest 247.84

130th cuota:

Amortization 561.07

Interest 247.84

Total Inerest:

$ 46,603.80

Step-by-step explanation:

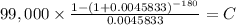

We will first calculate the mortgage payment. which is the PTM of the present value of an ordinary annuity

PV $99,000.00 (110,000 - 10% down payment)

time 180 (15 years x 12 month per year)

rate 0.004583333 (0.055 divided by 12 month per year

C $ 808.91

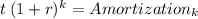

Now we will calculate "t" which is the amortization ofthe first period:

Cuota - Interest = t

interest: 99,000 x 0.00548333 = 453.75

808.91 - 453.75 = 355.16

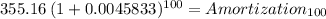

Now will calculatize this by 100 period

and by 130 period to get the amortization in each k period.

t = 355.16

k = 100

rate 0.00458

Amortization 561.07

For interest we subtract from the cuota:

808.91 - 561.07 = 247.84

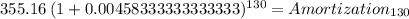

We repeat for the 130th payment:

Amortization 643.58

808.91 - 561.07 = 247.84 interest

Total Interest:

Cuota x total payment - principal

808.91 x 180 - 99,000 = $ 46,603.80