Answer:

COGS for 2018 : 119,300

Step-by-step explanation:

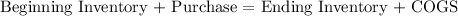

We use the inventory identity to solve for Cost of Goods Sold:

The right side are the input of inventory: it can be from previous prior and purchase from the period. And the left side are the destination, it can be on stock or sold.

We plug our values into the formula and solve for COGS

100,000 + 27,000 = 7,700 + COGS

COGS = 100,000 + 27,000 - 7,700 = 119,300