Answer:

cash flow third year: 23,212

Step-by-step explanation:

the economic equivalent value means the third payment will make the project equal to 50,000 today at 5% discount rate.

It mill make both option equivalent.

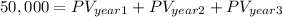

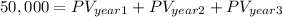

So the present value of the three payment will be 50,000.

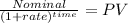

We will calculate each PV:

First year:

Nominal: 10,000.00

time 1 year

rate 5% = 0.05

PV 9,523.81

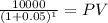

Second Year:

Nominal: 15,000.00

time 2 years

rate 0.05

PV 13,605.44

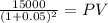

Now, we go back to our previous formula:

50,000 = 9,523.81 + 13,605.44 + PV3

And solve for PV of third year:

PV3 = 26,870.75

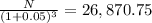

Now we go into the formula for PV and solve for the nominal

Third Year:

Nominal: N

time 3 years

rate 0.05

PV 26,870.75

N = 23211.96415

The third year cash inflow should be for this amount to made the project economic equivalent