Answer:

COGS = 118,000

Step-by-step explanation:

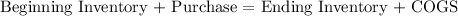

From the inventory identity we will solve for COGS

the right side is the origin of the goods, are either purchased or come from prior period

the left side, is the destination, the use of the goods, it could either be sold or is still in stocks.

Now, to sovle, we plug our values and clear for COGS

15,000 + 130,000 = 27,000 + COGS

COGS = 15,000 + 130,000 - 27,000

COGS = 118,000