Answer:

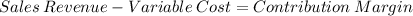

BEP units: 15,000 60-pounds bags

(B)

14,000 generates 6,000 loss

35,000 generates 120,000 net

(C) operating leverage: 2

(D) financial leverage: 1.63

(E) combined leverage: 3,26

Step-by-step explanation:

60 pounds sales price = $ 15

60 pound cost: 60 x 0.15 = $ 9

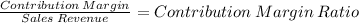

Contribution Margin 6

Fixed Cost 90,000

BEP units: 15,000

(B) profit at given level:

sales x margin - fixed cost = net profit

14,000 x 6 - 90,000 = (6,000)

35,000 x 6 - 90,000 = 120,000

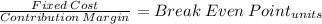

(C) operating leverage: change in EBIT / change in sales

income at 21,000 x 6 - 90,000 = 36,000

EBIT change:

120,000/36,000 = 3 + 1/3

Slaes change:

35,000/21,000 = 1 + 2/3

operating leverage:

(3 + 1/3) / (1 + 2/3) = 2

(d) financial leverage

change in net income:

(120,000 - 17,000) / (36,000 - 17,000)

103,000 / 19,000 = 103/19

change in EBIT 3 + 1/3 (already calculate

(103/19) / (3+1/3) = 1.626315789

(E) combined

2 x 1.626315789 = 3,252631578