Answer: 11.48%; 11.47%

Step-by-step explanation:

Given that,

Dividend Issued on common stock = $1.20 per share

Dividend paid in last four years:

$.85 per share

$.92 per share

$.99 per share

$1.09 per share

Stock currently sells at = $53

Calculation of growth rates in dividends :

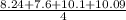

G1 =

= 8.24%

G2 =

= 7.6%

G3 =

= 10.1%

G4 =

= 10.09%

(1) Arithmetic growth Rate =

= 9.01%

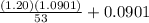

Cost of Equity =

= 11.48%

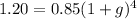

(2) Geometric growth Rate

G = 9%

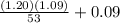

Cost of Equity =

= 11.47%