Answer:

Ans. The carrying value of this bond on Dec. 31/17 is $25,185,800.90

Step-by-step explanation:

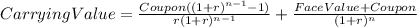

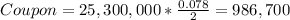

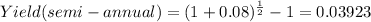

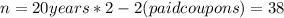

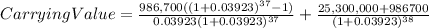

Hi, the carrying value of this debt depends on the unpaid coupons and its principal, and since 2 semi-annual coupons were already paid, we have to bring to present value (to Dec /17) the remaining coupons and the principal to be paid. The formula is as follows.

Where:

Best of luck.