Answer:

Expected return = 14.14%

Step-by-step explanation:

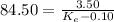

Using the dividend growth model we have,

Where P0 represents current market price of the share.

D1 = Dividend at year end = $3.50

Expected growth rate = g = 10%

Ke = Expected Return

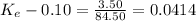

Now putting values in above, equation or formula we have

Ke = 0.0414 + 0.10 = 0.1414 = 14.14%

Thus, expected return = 14.14%