Answer:

The second year’s depreciation for this equipment using the straight line method is 8,500

Step-by-step explanation:

Depreciation: Depreciation is a decreasing value of the assets due to the tear & wear, obsolescence, usage,etc.

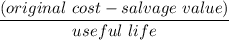

The formula to compute the depreciation under straight lie method is shown below:

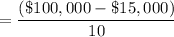

=

=

= $8,500

The depreciation amount under straight line method should remain same over the estimated useful life

So, the second year’s depreciation for this equipment is $8,500