Answer:

c. If a company's tax rate increases, then, all else equal, its weighted average cost of capital will increase.

Step-by-step explanation:

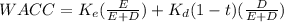

We will analize based on the WACC formula:

(C) Incorrect, if the tax-rate increase, notice the cost of debt tax-shield will be higher, therefore it will generate a lower WACC

asumming a debt cost of 10%

if the tax-rate is 20% 10% ( 1 - 20%) = 8%

if the tax-rate is 50% 10% ( 1 - 50%) =5%

the cost of debt is lower, thus the WACC will be lower to.