Answer:

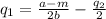

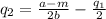

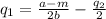

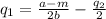

The best response functions are given by

Step-by-step explanation:

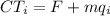

Under no fixed costs the total costs is

for i=1,2. The market demand is given by

where

is the total production

is the total production

Firm 1 and 2 will maximize its own profits. Since this firms are symmetric the problems are too

The first order conditions (take derivative of the profit with respect to

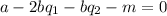

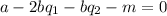

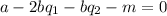

are given by

are given by

Then the best-response function for Firm 1 will be

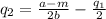

and the solution for Firm 2 would be the symmetric

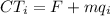

Now we can add fixed costs, so total costs now look

for i=1,2

for i=1,2

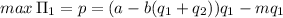

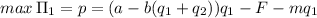

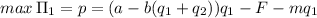

the profit maximization problem for firm 1 looks now

The first order conditions are given by

note that this equation is the same as in the absence of Fixed Costs. So the solutions would be the same. Fixed costs don't change the optimal level of production of these firms.

Note that Total Costs are given by fixed costs (F) and marginal costs (m) that depend on the production level of the firm

for i=1,2. The market demand is given by

where

is the total production, so it's the sum of each firms production

is the total production, so it's the sum of each firms production

Firm 1 will maximize it's own profits

The first order conditions (take derivative of the profit with respect to

are given by

are given by

Then the best-response function for Firm 1 will be

and the solution for Firm 2 would be symmetric.

Note that only marginal costs are relevant for getting the best-response function, so adding fixed costs (F) don't change the results

Step-by-step explanation: