Answer:

WACC 11.80960%

Step-by-step explanation:

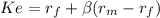

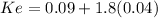

For the cost of capital we will use the CAPM model

risk free 0.09

market rate 0.13

premium market = (market rate - risk free) = 0.04

beta(non diversifiable risk) 1.8

Ke 0.162 = 16.2%

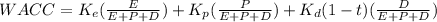

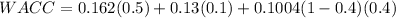

Then we can calculate the WACC

Ke=cost of capital= 0.162 (according to CAPM)

Equity weight =0.5

Kp= return on preferredstock = 0.13

Preferred Weight = 0.1

Kd= we use the actual market rate for the bebt = 10.04% = 0.1004

Debt Weight = 0.4

tax-rate = 40% = 0.4

WACC 11.80960%