Answer:

The capitalized cost fo the machine is 570,010.68

Step-by-step explanation:

We will calculate the present value of the machine under these payment and calcualte the implicit interest.

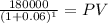

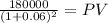

We will use the formula for present value of a lump sum:

Maturity 180,000

time 1

rate 0.06

PV $169,811.3208

Maturity 180,000

time 2

rate 0.06

PV $160,199.3592

240,000 + 169,811.32 + 160,199.36 = 570,010.68

And there are 600,000 - 570,011 = 29,989 interest