Answer:

The EMV for option a is $4,971,200

The EMV for option b is: $6,101,600

Therefore, option B has the highest expected monetary value.

Step-by-step explanation:

The EMV of the project is the Expected Money Value of the Project.

This value is given by the sum of each expected earning/cost multiplied by each probability.

So

(a) Proceeding immediately with production of a new top-of-of-the-line stereo TV that has just completed prototype testing.

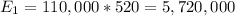

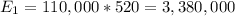

The firm can expect sales to be 110,000 units at $520 each, with a probability of 0.68 and a 0.32 probability of 65,000 at $520. So:

are the earnings of selling 110,000 units at $520 each. So:

are the earnings of selling 110,000 units at $520 each. So:

are the earnings of selling 65,000 units at $520 each. So:

are the earnings of selling 65,000 units at $520 each. So:

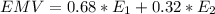

The EMV for option a is:

(b) Having the value analysis team complete a study

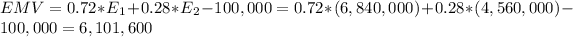

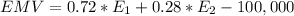

The firm expets sales of 90,000 units at $760, with a probability of 0.72 and a 0.28 probability of 60,000 units at $760. Value engineering, at a cost of $100,000, is only used in option b. So:

$100,000 is a cost, so it is subtracted.

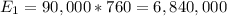

are the earnings of selling 90,000 units at $760 each. So:

are the earnings of selling 90,000 units at $760 each. So:

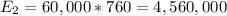

are the earnings of selling 60,000 units at $760 each. So:

are the earnings of selling 60,000 units at $760 each. So:

The EMV for option b is: