Answer:

Since the cost of buying on credit card is less

hence, buying from credit card is best option.

Explanation:

Given;

Terms of lease as:

$250 down

monthly payment = $100 for 12 months

cost of purchase at the end of lease period = $300

Thus,

the total cost of buying on lease terms = $250 + ( 12 × $100 ) + $300

or

the total cost of buying on lease terms = $1750

Now,

For second alternative

Monthly payment = $130.00

Duration = 12 months

Rate of interest = 18%

monthly rate of interest, r =

= 1.5% = 0.015

= 1.5% = 0.015

Now, using the compounding formula

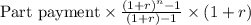

Th total cost =

on substituting the values, we get

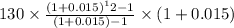

Th total cost =

or

the total cost = $1720.78

Since the cost of buying on credit card is less

hence, buying from credit card is best option.