Answer:

The number of years she has to live to come out ahead is 11 (or 10.47 to be precise).

Step-by-step explanation:

We know that she breaks even the the net present value (NPV) is 0. Having the following data:

- Initial value (IV) = -$200,000

- Final value (FV) = 0

- Interest rate (r) = 5% = 0.05

- Payment (P) = $25,000

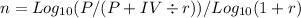

The formula for the number of years she must live to come out ahead (n) is given by:

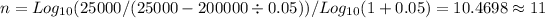

Replacing in the formula with the known values we have:

Therefore the number of years grandma has to live to come out ahead is 11 (or 10.4698 to be more precise).