Answer:

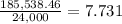

TIE Ratio = 7.731

Step-by-step explanation:

Provided information we have,

TIE Ratio =

Interest = $300,000

8% = $24,000

8% = $24,000

Net profit = Sales

Net profit margin = $1.5 million

Net profit margin = $1.5 million

7% = $105,000

7% = $105,000

Now this profit is after tax,

Profit - 35% of profit = $105,000

65% of profit = $105,000

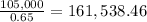

Profit before taxes =

Profit before taxes + Interest = Earnings before interest and taxes = $161,538.46 + $24,000 = $185,538.46

Therefore,

TIE Ratio =

Therefore, the bank will renew the loan as the TIE Ratio is more than 5.