Answer:

Project A

Step-by-step explanation:

Given:

The payback period for the project A = 18 months

Cost of project B = $125,000

Expected cash flow for the first year for the project B = $50,000

Cash flow per quarter after first year = $25,000

Now,

Remaining cost for project B after the first year payment

= $125,000 - $50,000

= $75,000

payback period for the project B after the first year

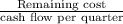

=

=

= 3 quarters = 9 months

therefore,

the total payback period for project B = 1 year + 9 months = 21 months

hence, Project A should be recommended as the payback period for project A is less i.e 18 months